A risk management information system (RMIS) helps businesses to be wary of potential risks. The best risk management software tracks and analyze several risk factors that could impact a company’s reputation.

An RMIS System is super easy to access from different locations and on different devices. It’s a flexible and agile solution, that can keep up with the changing needs of a business. By using a project risk software, businesses can prepare themselves for uncertainties and keep themselves protected.

What are The Features of RMIS?

Many organizations view RMIS as a claims management and incident reporting tool, but it does so much more than that. Every RMIS has its own set of features, some of them are custom-made for specific industries, ranging from construction to healthcare.

To begin with, an RMIS offers a selection of features and modules that collect data. A larger, more comprehensive RMIS will include modules for businesses that need it. Some of these modules include policy management, premium calculation, financing risks, contracts, and vendor management.

An ideal RMIS should also include flexible reporting tools to make sure all the information is stored in a useful format. These tools are available in a fixed template format, but other tools are customized to meet the needs of an individual organization.

Moreover, an RMIS should help in automation. This way, businesses don’t have to input data manually. Today, RMIS reduces administrative burdens and improves data accuracy by automating the process to eliminate human error from the process.

Why Should Businesses Get RMIS?

Before a business invests in an RMIS, they’ll often maintain multiple spreadsheets and databases, and different siloed systems collecting data. A major goal of RMIS is to gather information and store it all in one place.

A completely integrated system can provide a great benefit to risk managers who need to make crucial decisions. Part of these functions of RMIS may even keep track of where physical online documents are stored.

If you’re planning to get an RMIS, then here are some of the most important reasons:

1. Expanding Responsibilities

Risk managers don’t just have to play a supporting role on a finance team. Today, they’re valued C-Level executives, and they’re responsible for presenting data to board members and other stakeholders regularly. They have to be able to access and manage the data that’s directly tied to their success.

2. Stricter Governance Regulations and More Insecurity

Running a business in today’s time is challenging and uncertain. The cost of mistakes grows higher and higher over time. There’s more at risk that you need to manage.

3. Brand Reputation

With a global economy and simple access to social media, every organization’s reputation is on the line every minute of the day. An organization’s ability to manage its reputation and prevent potential damage is a market of its success.

4. Access to More Data than Ever

There’s information all around, so collecting data in one place is more important than ever. It’s nearly impossible to manage all the information efficiently manually using spreadsheets. By using technology, however, the information becomes manageable and useful.

Which Businesses Can Benefit from RMIS?

Not every type of business needs to identify, evaluate, and prioritize risks. Businesses can run into risk from anywhere and expand at any time. The industries that can benefit from an RMIS are businesses that include insurance risks, such as construction, manufacturing, healthcare, hospitality, transportation, power and utility, and food and beverage.

Other businesses that have major liability concerns will benefit from an RMIS as well. Businesses that need an RMIS currently experience challenges around:

- Administration: Outdated systems, too much data to collect, or third-party admins.

- Risk Financing: Complicated insurance coverage with multiple carriers.

- Visibility: Unable to track business risks, from properties to vehicle fleets and other assets.

- International: Businesses that face the challenge with international insurance policies, multi-language or multi-currency requirements.

Why RMIS is Important for Businesses?

There are several reasons to use a risk management information system, and businesses can get several benefits. A business can use RMIS for many reasons including:

- Organizes Data: Having to handle more and more data is becoming challenging, an RMIS collects information from multiple sources, highlights errors gets rid of irrelevant data, and provides context for users. Developers can specify field limitations and verify all the data entries against available options.

- Automation: An RMIS helps transform data to compare like metrics. It helps in creating reports, and dashboards to collect information from several sources. An RMIS makes all the crucial information available to all Stakeholders and notifies relevant parties when a threshold has been reached.

- Collects and Organizes Information: An RMIS collects data from several sources into a single system, and it also helps in presenting data in several important ways.

- Saves Money: By offering improved data collection and risk management procedures, organizations can expect to avoid insurance gaps and overages. Additionally, working with a single system makes the process more efficient and saves a lot of time and money.

By using an RMIS regularly, businesses can have a huge impact. It can provide crucial insights that most businesses skip. Reduce administrative burden, improve data accuracy, and prevent business losses.

Reviewing the Best Risk Management Software

Here’s a brief breakdown of the best risk management systems that are featured on the top 10 list:

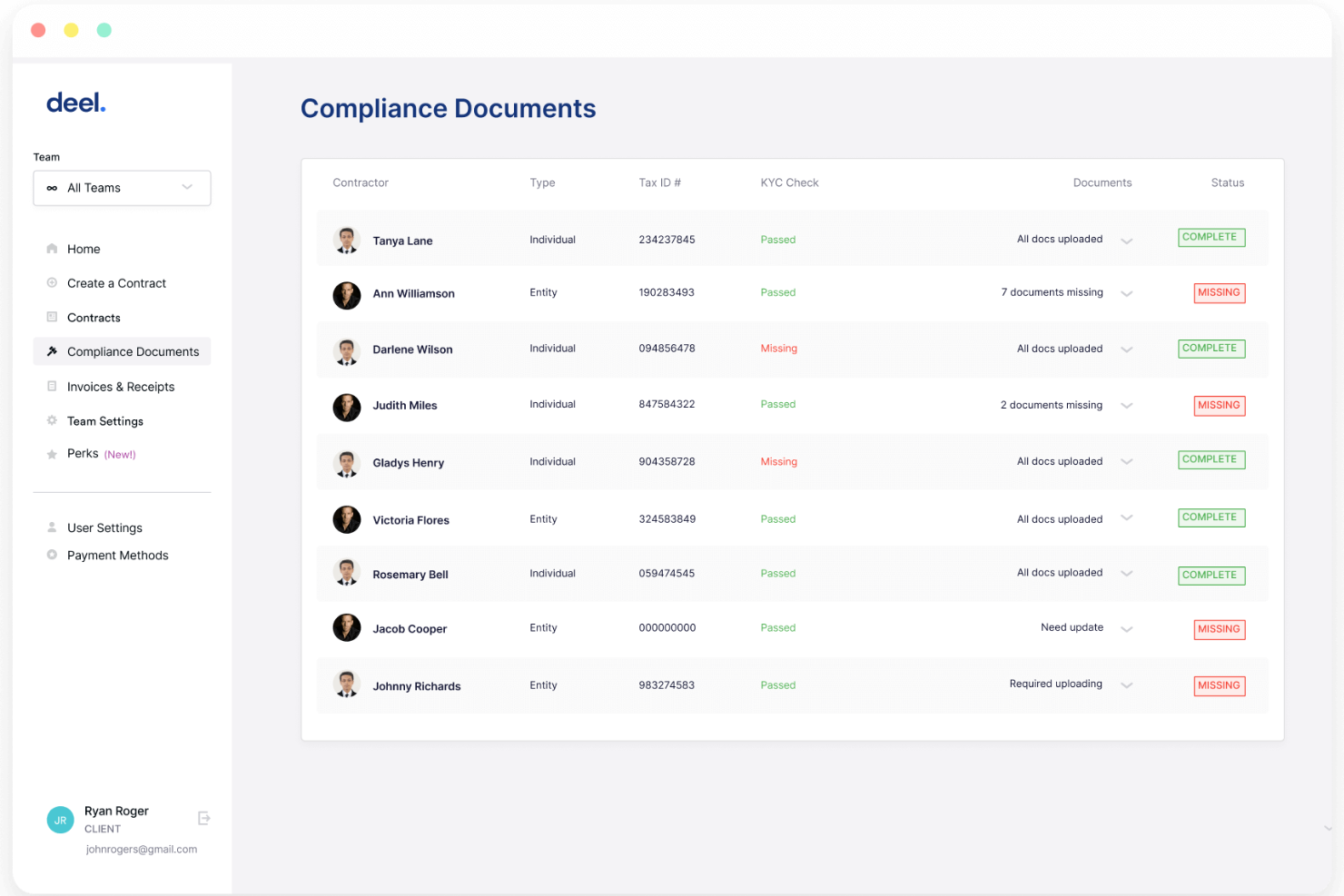

1. Deel – Best for Global Project Teams

Deel is one of the best risk management platforms in the market. It helps businesses build, manage, and grow their global workforce with compliance, payroll, and other benefits.

With Deel, businesses can onboard employees, pay international employees, and comply with local rules and regulations.

Deel is a lifesaver for teams spanning across the globe. The platform includes features for contract management, tax compliance, and the security of employee data. All of these are crucial for mitigating the risks that come with having a global team.

Moreover, Deel keeps businesses updated on local laws and regulations, so you can ensure compliance.

Supported integrations:

- Slack

- Berx

- Google Workspace

- Outlook

- QuickBooks

- Xero

- Jira, and many more.

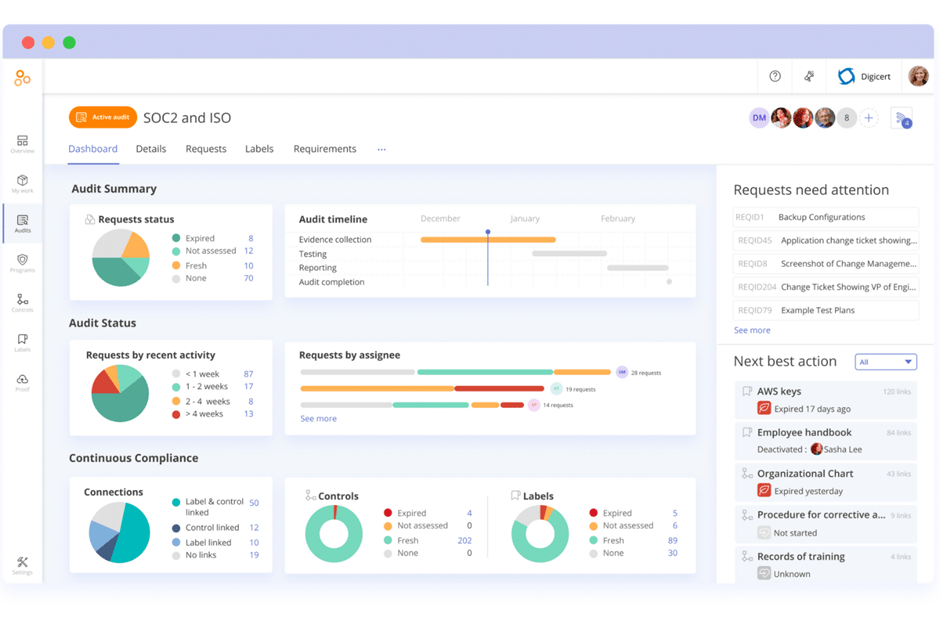

2. Hyperproof – Best for Planning & Performing Risk Audits

Hyperproof allows businesses to manage their risk and compliance programs. The platform is full of features that help business organizations identify, assess, and mitigate risks.

The best thing about Hyperproof is the platform’s risk management capabilities. It allows users to identify and prioritize risks based on their impact on businesses.

Hyperproof also lets users build and manage risk profiles for different parts of the organization and track and report risk mitigation.

Not just that, Hyperproof also offers other functionalities such as document management, task management, and reporting & analytics.

Supported integrations:

- Slack

Zoom - Microsoft Teams

- Jira

- Asana

- AWS

- Azure

- GitHub

- OneDrive

- Dropbox

- Drive

- Google Drive & more

3. StandardFusion – Best Risk Management Solution for Mid-Sized Businesses

StandardFusion is a comprehensive risk management solution that offers enhanced visibility into security risks and offers a space for collaboration to mitigate risks.

The platform is divided into six parts:

- Risk

- Compliance

- Audit

- Vendor

- Policy

- Incident

Each of them can be configurable with centralized data so users have enhanced visibility on all their risk and compliance programs. It can also produce an presentable report at any given time to satisfy stakeholders.

With StandardFusion by their side, security teams can manage risk proactively, grow revenue, boost productivity, and generate new business with ease.

One of the best reasons to use StandardFusion is its simplistic and powerful interface. The navigation is straightforward and you can explore everything with just a few clicks. If you end up facing any issues, there are in-depth training sessions and user guides you can look into.

Supported integrations:

- Jira

- Confluence

- Slack

- OpenID

- DUO

- Google Authenticator

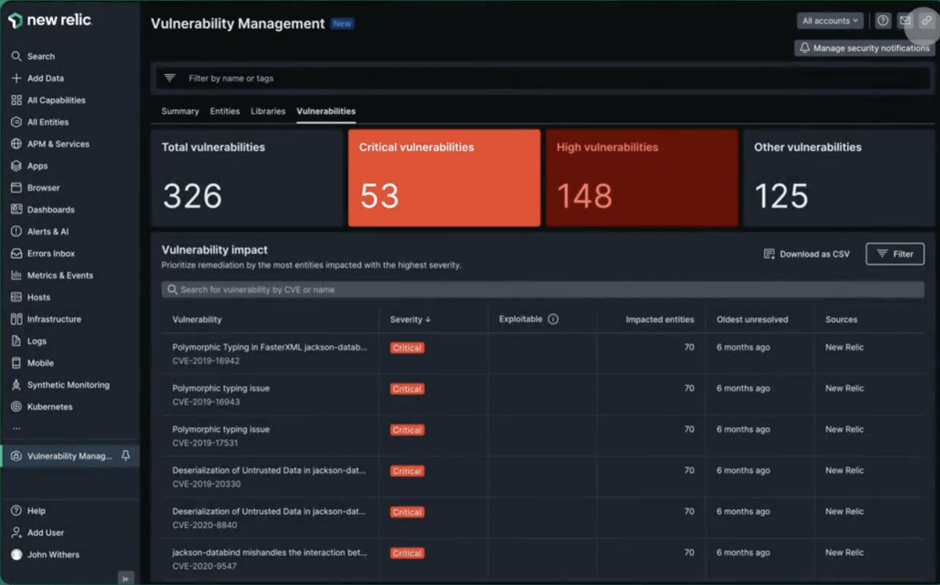

4. New Relic – Best All-in-one Observability Platform

New Relic is a comprehensive performance monitoring and management platform. It can be used to get a complete overview of applications, infrastructure, and customer experience at one place.

New Relic has an in-built AI assistant ‘Grok’ that can read your telemetry and identify outliers for you. You can ask it questions and it will find a root cause for you and suggest changes you can make.

Supported integrations:

- AWS

- Google Cloud

- Microsoft Azure

- Jenkins

- CircleCI

- Travis CI

- Slack & many more.

Fun fact: New Relic has an API section that you can use to build custom integrations.

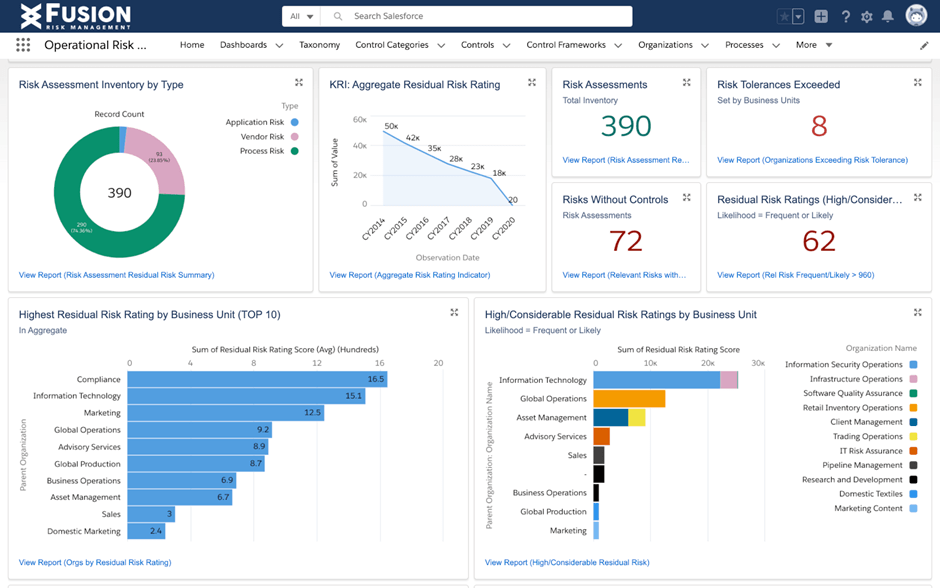

5. Fusion Framework System – Best Solution for Dependency Visualization

Fusion Framework System is a cloud-based operational resilience software (as they call it) that works on top of Salesforce. The platform helps businesses accelerate digital transformation of their risk management program by integrating data, processes, services all under one dashboard.

With it, you can visualize your business, products, and services from the customer’s POV, helping you build a map of daily functions of your business.

The software adapts to the business’s changing priorities and provide context for how risk intelligence should be applied. What makes Fusion Framework System a great solution? It allows you to complete risk assessments, track organization wide metrics, offers step-by-step guidance to manage controls, and fix issues.

Supported integrations:

- Everbridge’s emergency notification system & risk intelligence

- Send Word Now

- Onsolve

- ServiceNow

Conclusion

Choosing the right risk management system is crucial for businesses to identify, analyze, and resolve risks. Use our guide to choose the best solution for your business and keep yourself protected.